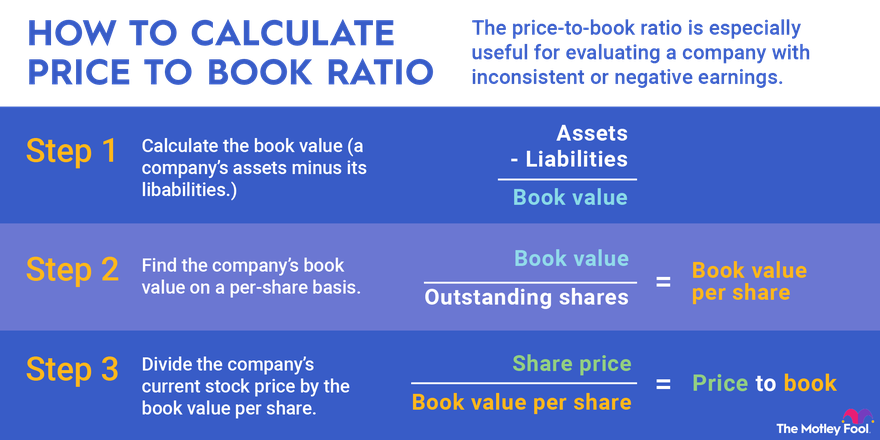

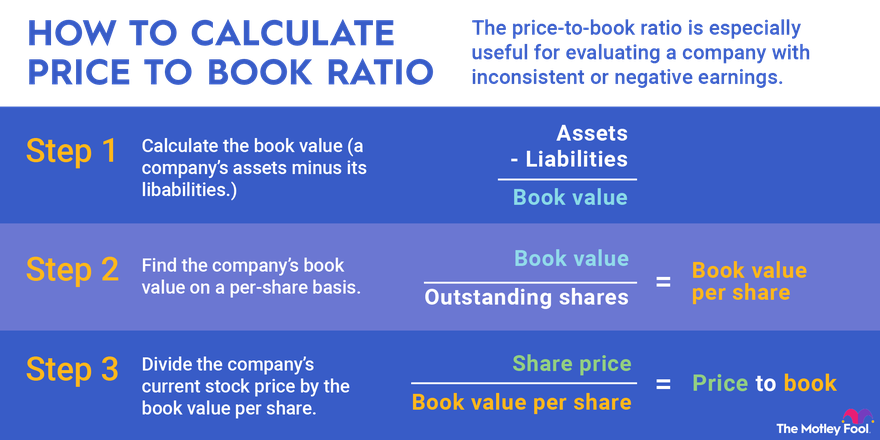

Price to Book Ratio Formula

PB ratio market price per. A high Price to Book ratio means that the market is appraising future business results optimistically as the value they are establishing for the business exceeds the book value of its.

Using Price To Book Ratio To Analyze Stocks

They all are one and the same.

. This means that the. Book value per share assets - liabilities. Both will result in the same result.

PBRatioMarketPriceperShareBookValueperSharePB Ratio dfrac See more. This gives a price to book ratio of 119. You can calculate the PB ratio using the following formulas below.

Tangible book value per share 5793 USD. Now to determine the price-to-book ratio we divide the current market price by the. Price to Book Value Formula The price to book value can be defined as a market value of a firms equity divided by the book value of its equity.

If we put the annual values into our price to book ratio calculator we will get a PB ratio of. The price-to-book ratio expresses a companys stock share price in relation to its book value per share BVPS. Price to tangible book value ratio 138.

PB ratio Market price per share Book value per share PB ratio 600 300 PB ratio 200 4. Market value per share is obtained by simply looking at the share price quote in the market. It is also called market to book ratio.

Price to Tangible Book Value - PTBV. PB ratio Market capitalisation Book value of assets Alternatively investors can derive this ratio as expressed below PB ratio Market price per share Book value of assets per share. The price to tangible book value PTBV is a valuation ratio expressing the price of a security compared to its hard or tangible book value.

Book value refers to a companys intrinsic financial worth. Evaluate the result This companys PB ratio is 2 which means that the. PB ratio market price book value.

Total assets - total liabilities number of shares outstanding. The formula for price to book value ratio is expressed as. In this equation book value per share is calculated as follows.

If this ratio of the stock is. The Price to Book ratio determines the relationship between the companys total outstanding shares and the net value of assets reflected in the balance sheet. To arrive at book-value-per share divide the book value by the number of shares outstanding as shown in the formula below.

Wipro Company has a share price of Rs6015 at the end of the year and a book value per share of Rs5020 at the end of the year. Book value per share 185703 171719 341 41. Price-to-Book Ratio PB Market Capitalization Book Value of Equity Alternatively the PB ratio can be calculated by dividing the latest closing share price of the company by its most.

The price-to-book ratio aka market-to-price ratio is a financial ratio that helps to see whether the company stock is overvalued or undervalued by comparing the companys market price and. 1 Market to Book Ratio formula Market value of stock Book value per share On the other hand it can also be calculated by dividing the market capitalization by the companys total book. Price to Book value ratio PB Market Capitalization Book Value of Equity Alternatively Price to Book value ratio PB Current.

Price to Book Value Ratio or PB Ratio is one of the most important ratios used for Relative Valuations. Consequently its price-book value ratio declined from 789 to 125. Now we can do some simple math.

Price to Book Value Ratio Price Per Share Book Value Per Share Please note that Book value Shareholders Equity Net Worth. The following graph shows the price-book value ratio as a function of the difference between the return on equity and. It is usually used along with other valuation tools like PE Ratio PCF PCF Price to.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Price To Book Ratio P B Formula And Calculator Excel Template

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

No comments for "Price to Book Ratio Formula"

Post a Comment